Following Lufthansa’s Capital Markets day this week, we have something a bit different for you: a weekend long-read analysing the implications of what the Lufthansa Group (LHG) is saying to its investors, including several rather noteworthy innovations — and what that means for the airline industry, for businesses who supply cabin interiors, and designers who create the passenger experience.

Highlights in this first part of our analysis include the Lufthansa Group’s problems and planned solutions, a new Lufthansa Group Lounge concept, the development of Lufthansa’s low-cost and leisure airlines, major backend consolidation of its hub airlines and where the group sees the opportunities for growth.

Next week, we’ll dive deeper into the fleeting and seating implications of the Lufthansa Group’s strategy, as well as where this leaves the majority of the group airlines that have not adopted the FICE/Allegris/Swiss Senses generation of products.

We’re working through the full 121-page slide deck that Lufthansa presented to its investors, covering:

- Strategy and value creation

- Market, positioning and growth

- One Group Network Airline, of which three sub-sections:

- Commercial offer

- Fleet modernisation & productivity

- Digital and technology

- Airlines transformation: Case study Lufthansa Airlines

- Financial performance & mid-term targets

Much of the messaging here is clearly aimed at the markets, which want to know that the capital investment is being allocated intelligently with the best returns, hence the focus on intercontinental (large incoming longhaul fleet), point-to-point (Eurowings), and leisure (Eurowings/Eurowings Holidays). But it’s especially interesting to see what the Group’s senior executives are saying about their passenger experience.

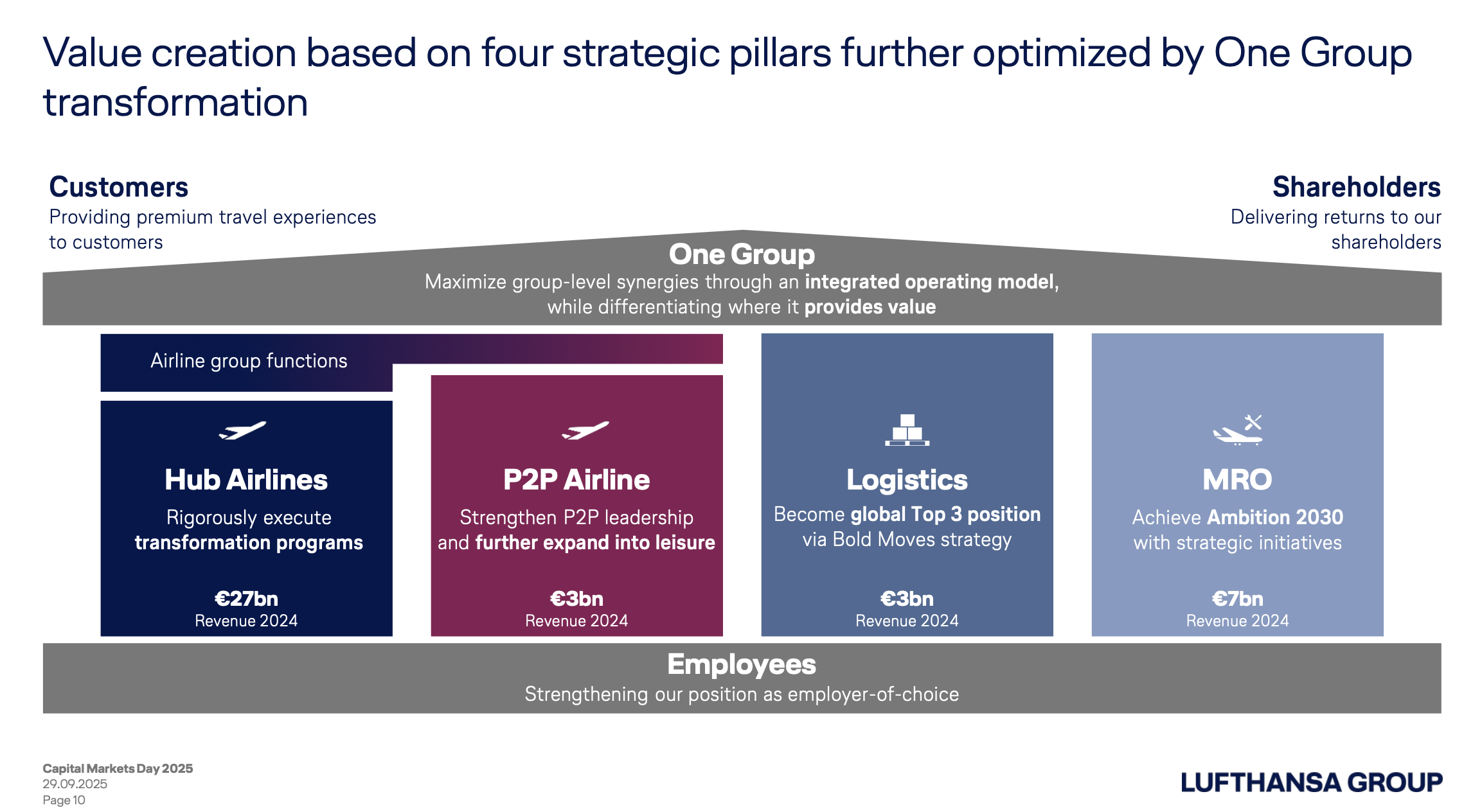

From the top down, Lufthansa sees its value creation in these four pillars, which it works through in subsequent slides, starting on page 10:

- the hub airlines (generally meaning Lufthansa, Austrian, Swiss, Brussels and sometimes ITA as it is incorporated)

- Eurowings and leisure

- Lufthansa Cargo

- Lufthansa Technik, its MRO (maintenance, repair, and overhaul) arm

Obviously, the first two of those pillars are highly relevant to most readers of The Up Front, with the admittedly large asterisked proviso that belly cargo has a substantial impact on airline profitability, and Lufthansa Technik has a substantial role in keeping aircraft flying, installing seats and/or cabin interiors during retrofit, and indeed in creating elements of Lufthansa’s passenger experience.

There is also a substantial contribution towards both the Cargo and Technik arms’ operation by the airline parts of the Group. This is often not adequately taken into consideration when talking about Cargo and Technik being golden children and the airlines being problem children.

But first, let’s drill down into the current state of the Lufthansa Group.